Welcome to NewAge Advisors

We provide comprehensive financial planning to federal employees and private clients. Our Federal Employee Group consists of any eligible federal employee requiring our services. Additionally, we specialize in assisting law enforcement officers of all classifications and also serve those with military service or military retirements.

Our Private Client Group is made up of successful business owners requiring advanced planning services due to the complexity of their business and estate. We work with a very limited number of private clients in order to provide the high level of service they deserve. Eligibility requirements apply.

Our mission is simple. We seek to empower and enrich the lives of our clint groups whom we’ve identified as remarkably underserved.

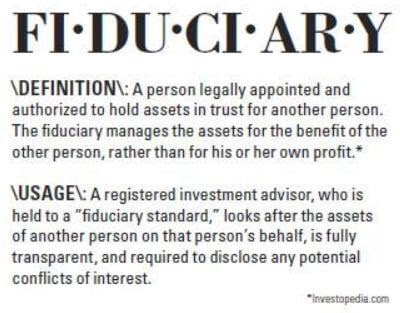

Our values are clear. As fiduciaries, we are obligated to act only in your best interest.